How to Ensure Customers use your App out of Habit

“Habit-forming products often start as nice-to-haves (vitamins) but once the habit is formed, they become must-haves (painkillers)”

— Nir Eyal

Habit Forming perspective is about understanding your target customer habits deeply so that using your product also becomes a habit for them.

This article is based on this extremely insightful book Hooked by Nir Eyal. He has literally made me walk through the customers mind to understand what are the triggers which will make them open up my app and start using it.

I will be explaining this on the basis of an example related to an online investment app. I have tried to understand each habit of my target customer and relate my app development to it so that whenever the user thinks of investment they should open up my app.

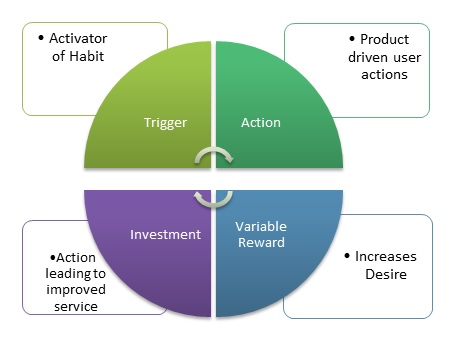

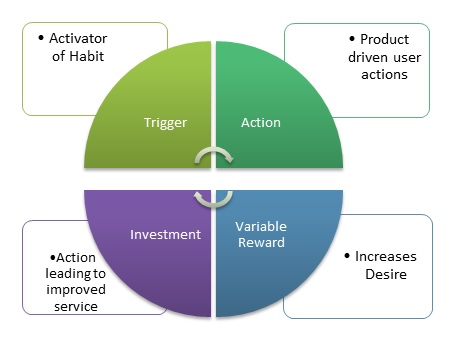

This analysis is done from 5 perspectives :

- Habit Zone

- Triggers

- Action

- Variable Reward

- Investment

THE HABIT ZONE

- What habits does your business model require?

- Regular investment habit.

- Periodic checking of investments being on the right track

- What problem are users turning to your product solve ?

- All investments at one place – doing and checking

- All investments at one place – doing and checking

- How do users currently solve that problem and why does it need a solution ?

- Investments are done at AMC websites in case of MF, banks for loans, government schemes

- Checking of investments is also at disparate places where investment is done

- Coagulation of all is to be done by the user himself

- How frequently do you expect users to engage with your product?

- Weekly (to check investments)

- Need case based – to make investments

- What user behaviour do you want to make into a habit ?

- Tracking investments

TRIGGERS

- Who is your product’s user?

- Age : 25-65

- Gender : Male/Female

- Concern : Wants to have a one-stop place to make and check investments

- What is the user doing right before your intended habit?

- Has finished work and settled down peacefully and starts thinking about investments

- Got up fresh on a weekend morning and feels this is a good time to make or check investments

- Come up three internal triggers that could cue your user to action. [Refer to the 5 Whys method]

- User wants to invest

- Why does the user want to invest

- To grow his money

- Why does he want to grow his money

- To meet his financial goals

- User wants to check his investments

- Why does the user want to check his investments

- To know if they are giving him positive returns

- User wants to invest

- Which internal trigger does your user experience most frequently?

- Need to check investments

- Need to check investments

- Finish this brief narrative using the most frequent internal trigger and the habit that you are designing : “Every time the user (internal trigger), he/she (first action of the intended habit)”

- Every time the user wants to track his investments he logs into a tool to check his investments

- Every time the user wants to track his investments he logs into a tool to check his investments

- Refer back to the question about what the user is doing right before the first action of the habit. What might be the places and times to send an external trigger?

- Late evening on email / sms / app notification / ad while browsing social media / viral video / referral email/sms /

- Weekend morning on email / sms / app notification / ad while browsing social media / viral video / referral email/sms

- How can you couple an external trigger as closely as possible to when the user’s internal trigger fires?

- Internal Trigger

- Check investment

- Make investment

- External Triggers

- Types

- Recommended funds

- Periodic portfolio report

- Auto rebalance notification (if subscribed)

- Modes

- Email (Paid)

- SMS (Paid)

- App notification (Paid)

- Ad while browsing social media (Paid)

- Weekend blog summary (Owned)

- Viral Video (Earned)

- Referral Email / SMS – Coax someone to pass educative info about an investment doing well, since people tend to listen to their peers / relative about money(Relationship)

- Types

- Internal Trigger

- Think of at least 3 conventional ways to trigger your user with current technology (emails, notifications, text messages, etc) Then stretch yourself to come up with at least 3 crazy or currently impossible ideas for ways to trigger your user (wearable computers, biometric sensors, carrier pigeons etc) You could find that your crazy ideas spur some new approaches that may not be so nutty after all. In a few years new technologies will create all sorts of currently unimaginable triggering opportunities.

- Investment game

- Personalised Postcard sent on address- “Congratulations. These investments of yours have performed really well”

- Portfolio bytes on wearable

- Monthly personalised portfolio update book

ACTION

- Walk through the path your users would take to use your product or service, beginning from the time they feel their internal trigger to th epoint where they receive their expected outcome. How many steps does it take before users obtain the reward they came for? How does this process compare with the simplicity of some of the examples described. How does it compare with competing products and services

- User wants to make an investment

- Registers / Logs into Fintoo

- Checks investments instruments

- Adds to cart

- Pays online to make investment

- User wants to check investment

- Registers / Logs into Fintoo

- Checks and analyses portfolio dashboard

- Delves more inside to check details

- User wants to make an investment

- Which resources are limiting your users’ ability to accomplish the tasks that will become habits?

- Time

- Brain cycles (Too confusing)

- Money

- Social deviance (outside the norm)

- Physical effort

- Non-routine (too new)

- Brainstorm 3 testable ways to make intended tasks easier to complete

- Email/App/SMS notifications for portfolio status

- Recommended fund notifications (app/email/sms)

- Periodic detailed reports

- Market bull and bear phases and related investment strategy

- Consider how you might apply heuristics to make habit-forming actions more likely

- Motivation

- Keep them motivated to ensure investments are on right track. Instil fear of wrong investments remaining wrong for a long time

- Ability

- Reminders

- Customised dashboard

- Clear CTAs on external triggers

- Triggers

- Listed above

- Motivation

VARIABLE REWARD

- Speak with five of your customers in an open ended interview to identify what they find enjoyable or encouraging about using your product. Are there any moments of delight or surprise? Is there anything they find particularly satisfying about using the product?

- All investments at one place!

- Online investing for all types of instruments

- Awesome Portfolio analysis

- Auto portfolio rebalancing

- Review the steps your customer takes to use your product or service habitually. What outcome (reward) alleviates the user’s pain? Is the reward fulfilling, yet leaves the user wanting for more?

- Mentioned above

- Mentioned above

- Brainstorm 3 ways your product might heighten users’ search for variable rewards using :

- rewards of the tribe – gratification from others

- App congratulations notification if an investment is doing really well

- rewards of the hunt – material goods, money or information

- Money growth with positive returns

- Recommendation of funds

- rewards of the self – mastery, completion, competency or consistency

- Achievement of investment goals

- Convenience of investment

- rewards of the tribe – gratification from others

INVESTMENT

- Review your flow. What “bit of work” are your users doing to increase their likelihood of returning

- Logging into the app regularly to check investments

- Setting auto deduction for some investments

- Subscribing to reminders

- Spending time on portfolio

- Applying recommendations

- Brainstorm 3 ways to add small investments into your product to :

- Load the next trigger

- General next triggers at all places

- Subscribe to emails / sms

- Visit blog

- App notifications

- Follow on social media

- Makes investment

- Cross sell other investment instruments

- Check out minty for holistic advice

- Checks portfolio

- Show next reminder to review

- provide an option to setup an ad hoc review

- Suggest auto portfolio rebalancing

- General next triggers at all places

- Store value as data , content, followers, reputation and skill

- Data

- Link bank accounts

- ITR data

- Investments performance

- Content

- Money education (Blogs, Emails, weekly digest)

- Followers

- Social media

- Reputation

- Client testimonials

- Referrals

- Data

- Load the next trigger

- Identify how long it takes for a “loaded trigger” to re-engage your users. How can you reduce delay to shorten time spent cycling through the hook?

- Mostly a minute – Email, SMS, App notification etc

- Mostly a minute – Email, SMS, App notification etc

HABIT TESTING (TO BE ANSWERED AFTER PRODUCT LAUNCH AND DOING COHORT TO ANALYSE USERS AND THEIR BEHAVIOURS AND THE TWEAKS NEEDED TO IMPROVE THINGS)

- Perform habit testing as described to identify the steps users take toward long term engagement

- Be aware of your behaviours and emotions fo rthe next week as you use everyday products. Ask yourself

- What triggered me to use these products? Was I prompted externally or through internal means

- Am I using these products as intended?

- How might these products improve their onboarding funnels, reengage users through additional external triggers, or encourage users to invest in their services?

- Speak with 3 people outside your social circle to discover which apps occupy the first screen on their mobile devices. Ask them to use these apps as they normally would and see if you uncover any unnecessary or nascent behaviours

- Brainstorm 5 new interfaces that could introduce opportunities or threats to your business.

Comments are closed.