Startup Fund Raising

Secure Your Startup’s Future: Master Funding Strategies, Woo Investors, and Craft Your Success Story!

Instructor: Dr. Anu Khanchandani

Language: English

WHO IS THIS PROGRAM FOR?

Entrepreneurs with a Business Idea

Entrepreneurs with a Business Idea

Legacy Businesses looking for Digital Transformation

Employees aspiring to be Entrepreneurs

Students aspiring to be Entrepreneurs

Family Business Owners looking for Digital Transformation

Homemakers with Business Ideas

Retired Professionals wanting to invest in a Startup

About the course

Explore the process of determining your startup’s funding requirements and securing investments from suitable sources like Angel Investors or Venture Capitalists. Understanding your projected Expenses, Revenue, and Profit and Loss Statements is crucial for your startup’s success.

Armed with this knowledge and your self-funding capabilities, you can assess the exact funding needed, bridging any deficits. Even if you opt for self-funding, aligning your finances with your goals is essential.

In this program, you will:

- Assess the Addressable Market Size

- Determine the required Funding

- Estimate Valuation & Term Sheet

- Explore Fundraising Levels

- Identify potential investors

- Find the right investor match

- Master the art of negotiation with investors

- Craft a compelling Investor Pitch Deck

- Participate in workshops

- Submit workshop assignments for review

- Receive personalized one-on-one sessions for further guidance

|

|

Thank you for Signing Up |

|

|

Thank you for Signing Up |

Course Contents

01. Startup Fund Raising

10 attachment(s) • 55 min 16 sec

- Assessing the Addressable Market Size

- How much Funding do you need

- Estimating Valuation & Term Sheet

- Fundraising Stages

- Where to find investors?

- Finding the right investor match

- Negotiation with Investors

- Crafting the Investor Pitch Deck

- Startup Funding Raising - Workshop

- Startup Fund Raising - Workshop Submission

READY-TO-USE STARTUP TEMPLATES

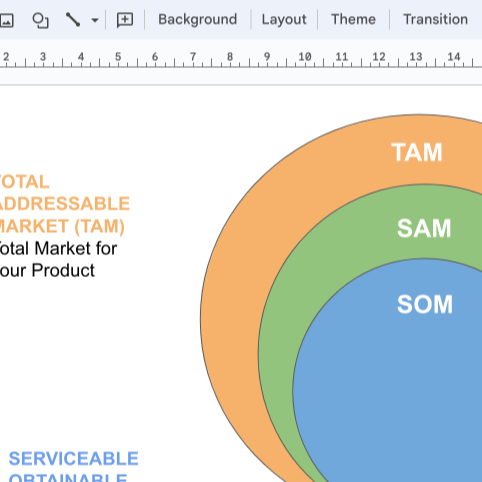

ASSESS MARKET SIZE

Research and arrive at figures for TAM SAM SOM.

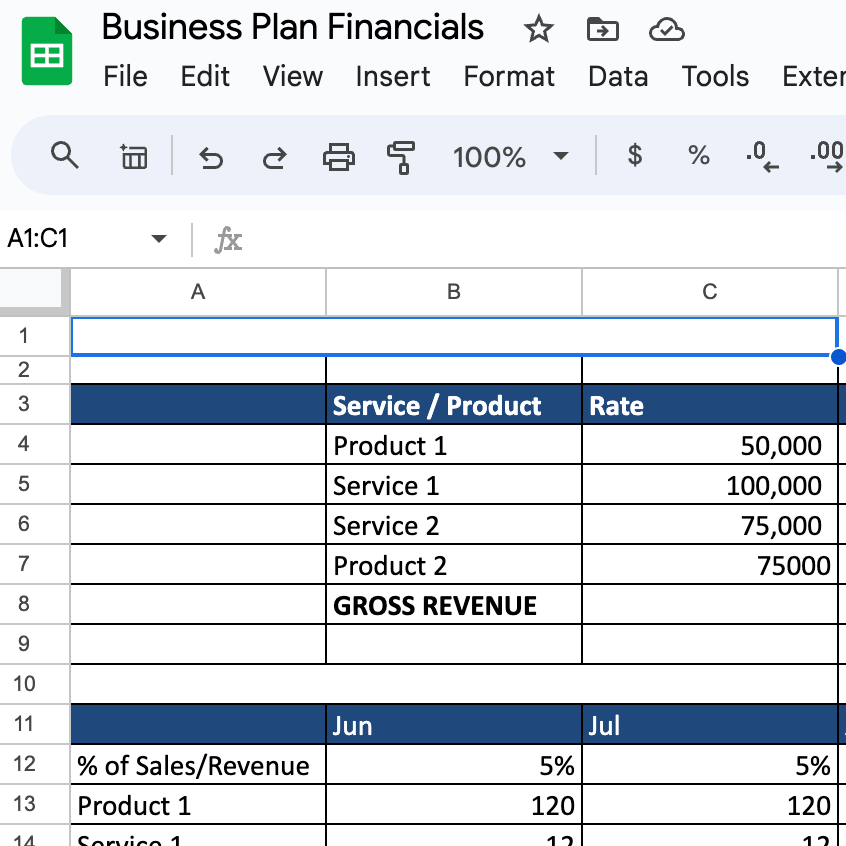

BUSINESS FINANCIALS

Work out your projected expenses and revenue models.

PITCH DECK TEMPLATE

Present your facts in an Investor Pitch Deck.

|

|

Thank you for Signing Up |

|

|

Thank you for Signing Up |

HOW IT WORKS

Step One

Complete the self-paced course with the practical documentation

Step Two

Book an appointment with Dr. Anu Khanchandani

Step Three

Have an one-on-one brainstorming session to review your understanding

MEET YOUR COACH

I’m Anu Khanchandani, immersed in the digital product industry since 1997, holding diverse roles both in India and abroad. I’ve contributed significantly to CMM-Level 5 organisations such as Syntel (India), Delta Technology (USA), and Reuters Asia (Singapore).

As a CTO and Principal Mentor, I’ve guided numerous Indian startups throughout their digital evolution, spanning from establishing their online presence to innovating advanced artificially intelligent products and platforms.

With over two decades as an employee, entrepreneur, and consultant in the digital startup sphere, I’ve witnessed the journey and the intricate challenges it presents. Whether in product design, marketing, sales, or fundraising, every step requires careful planning and execution, emphasising patience over impulsive decisions.

My purpose now is to support you along this path—driven by the belief that it’s time to reciprocate to the digital realm the wisdom it has imparted to me over the past two decades.

|

|

Thank you for Signing Up |

|

|

Thank you for Signing Up |

TESTIMONIALS

FAQs

1. Who is this workshop designed for?

This workshop caters to startup founders, entrepreneurs, and individuals seeking guidance on determining funding requirements and securing investments for their startups. Whether you’re initiating a new venture or aiming to refine your funding strategies, this workshop provides essential insights.

2. What is the primary focus of this workshop regarding startup funding?

The workshop emphasizes the process of determining funding requirements, understanding projected expenses, revenue, profit and loss statements, and securing investments from suitable sources like Angel Investors or Venture Capitalists. It covers crucial aspects such as assessing market size, funding estimation, valuation, term sheets, fundraising levels, investor identification, matching with the right investors, negotiation techniques, crafting compelling pitch decks, and engaging workshops.

3. How does this workshop assist in understanding funding needs and investor strategies?

Attendees will learn to assess their startup’s addressable market size, determine funding requirements, estimate valuations and term sheets, explore different fundraising levels, identify potential investors, match with suitable investors, master negotiation skills, and craft persuasive investor pitch decks.

4. Can this workshop benefit startups with varying funding requirements?

Absolutely. Whether you’re in the early stages and need initial funding or seeking investments for growth and expansion, this workshop provides strategies adaptable to various funding needs.

5. Will participants receive personalized guidance and reviews during the workshop?

Yes. The workshop includes interactive elements such as workshops, workshop assignment submissions for review, and personalized one-on-one sessions. These components ensure attendees receive personalized guidance and feedback tailored to their specific startup funding goals.

6. How can this workshop benefit individuals with limited self-funding capabilities?

The workshop equips participants to assess their funding needs accurately, even if they opt for self-funding. Understanding how to align finances with business goals is essential for maximizing resources and leveraging external funding opportunities effectively.

7. How can I enroll in this workshop to refine my startup’s funding strategies?

Enroll now on this page itself to participate in this comprehensive workshop that guides you through the process of determining funding requirements, securing investments, and mastering effective strategies for successful fundraising.

|

|

Thank you for Signing Up |

|

|

Thank you for Signing Up |