How much Startup Funding do you need?

That’s the secret. Convince yourself your Startup is worth investing in, and then when you explain this to the investors they’ll believe you.

Paul Graham, Founder, Y-Combinator

Most of the Startup Founders that I have coached / consulted till now have given me a dazed and confused look when I have asked them “How much Funding do you need?”.

And come to think of it at the beginning of their association, when I asked them what was their biggest challenge they said “Bas Funding ka karwa do Ma’am, baaki sab ho jaayega (Just get us the Funding somehow Ma’am, the rest will be taken care of)”

And I completely understand the sentiment behind this challenge. Especially, as a non-finance person myself, I understand that playing around with numbers is a pain. However, when I actually went to do it, I realised it involves just 2 skills – logic and simple arithmetic.

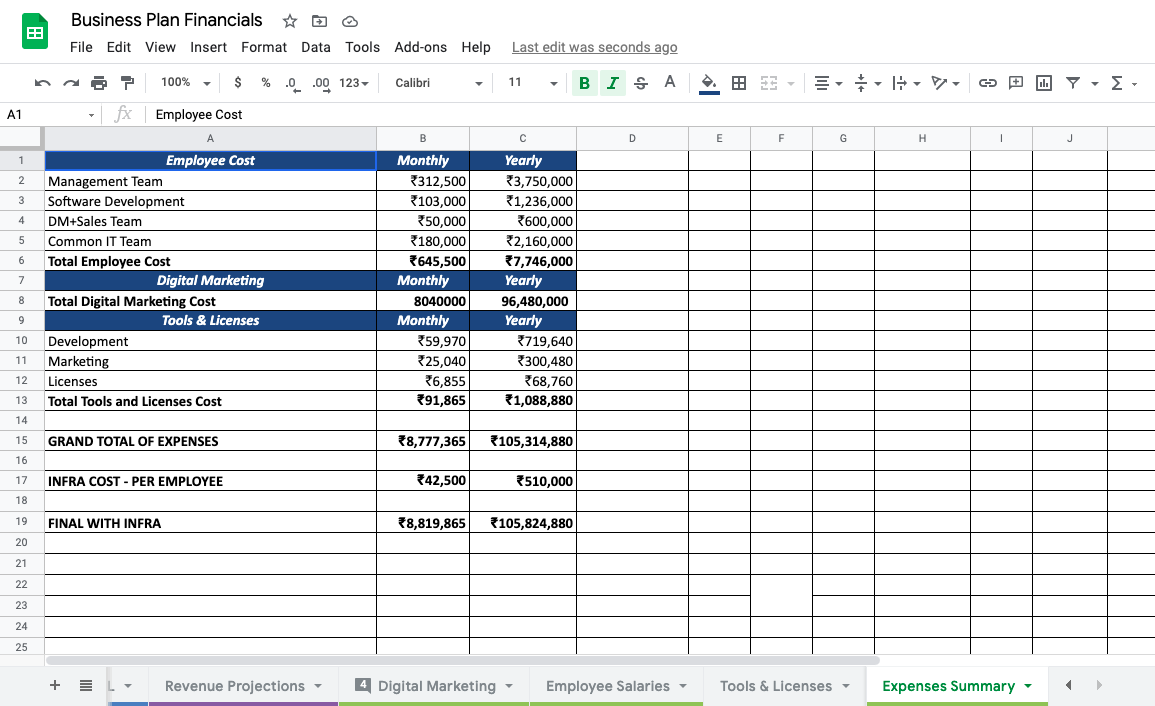

So much so, that I put all my workings into a Google Sheet and created a Startup Business Financials Template at the request of many Startup Founders, so that they could just key in their numbers and get an idea about projected Expenses, Revenue and PnL Statements. Powered with that information and the money that they can use for Self Funding their Startup , they would have an idea of exactly how much Funding is needed, based on the deficit. For that matter, even if you are going on the self-funded path this can help you align your finances with your goals.

These are not detailed financial calculations involving EBITDA or Cash Flow, but estimations of projections based on pure logic which every Startup Founder can work out for his/her own Startup.

Projected Revenue Calculations

It all starts with your Dream Revenue Figure. Say, you decide it is Rs. 5000 per year. (this is very conservative I know, but I’m just trying to keep the calculations simple for you to understand 🙂 )

Let’s assume you have a products – P1. Deciding the pricing for each unit of that product is a science in itself. Will probably write something on it soon but till then you can refer to this popular articles to decide the pricing for each unit of each product.

Say, the unit pricing for P1 is Rs. 10 based on all the research that you did.

To achieve your dream figure of Rs. 5000 in a year, you have to sell, say, 500 units P1 over the year. In other words, you need 500 customers for P1.

This calculation has led you to a very important Figure – No. of customers needed.

NEED HAND-HOLDING FOR YOUR STARTUP?

Projected Expense Calculations

This is the biggest pain point to arrive at.

Each Startup will have its own Expense Accounts. For a general understanding I am considering 3 main Expense Accounts here.

- Employee Salaries

- Tools

- Marketing Costs

Employee Salaries Expenses

Before even deciding Employee Salaries, you need to work out the Team Structure carefully. Keep in mind, that this gets a little out of hand because as a Startup Founder you want to achieve everything in as less time as possible. Be a little frugal here and consider team members which you need as a bare minimum.

If you need to go deeper on this more I have created a complete course covering all aspects of a Startup from Idea to Launch using the 7-Step Startup Success Formula which I have derived based on my 25 year experience with Startups.

Tools Expenses

I am a firm believer in the concept of Automation.

Automate as much as you can since as a Startup Founder, there is no end to the things that you have to manage. Having said that, it doesn’t mean that you have to lose complete control over your Work-Life Balance. (Another post on that coming soon). Subscribing to some basic tools like Asana for Task Management, Zoho for Marketing, CRM , Canva for Social Media Post creation and many more like that which you can check out in this article “How to run your Startup in Robot Mode“

Yes, there is a cost involved, but think about the time and energy that you save when you delegate half your work to an Automation Tool. As a Startup Founder, time is money for you, so don’t be frugal on this expense.

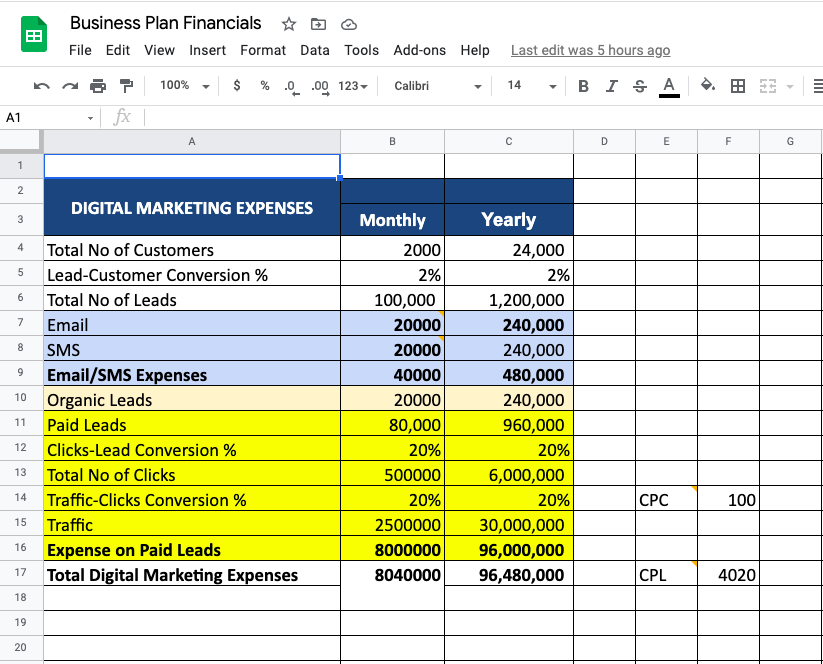

Marketing Expenses

This calculation is a little complex, but finally based on logic and simple arithmetic.

“Paid is Freedom”, I have often heard. So Paid Marketing is holy grail of all your expenses and will form the biggest chunk of your Expense Sheet.

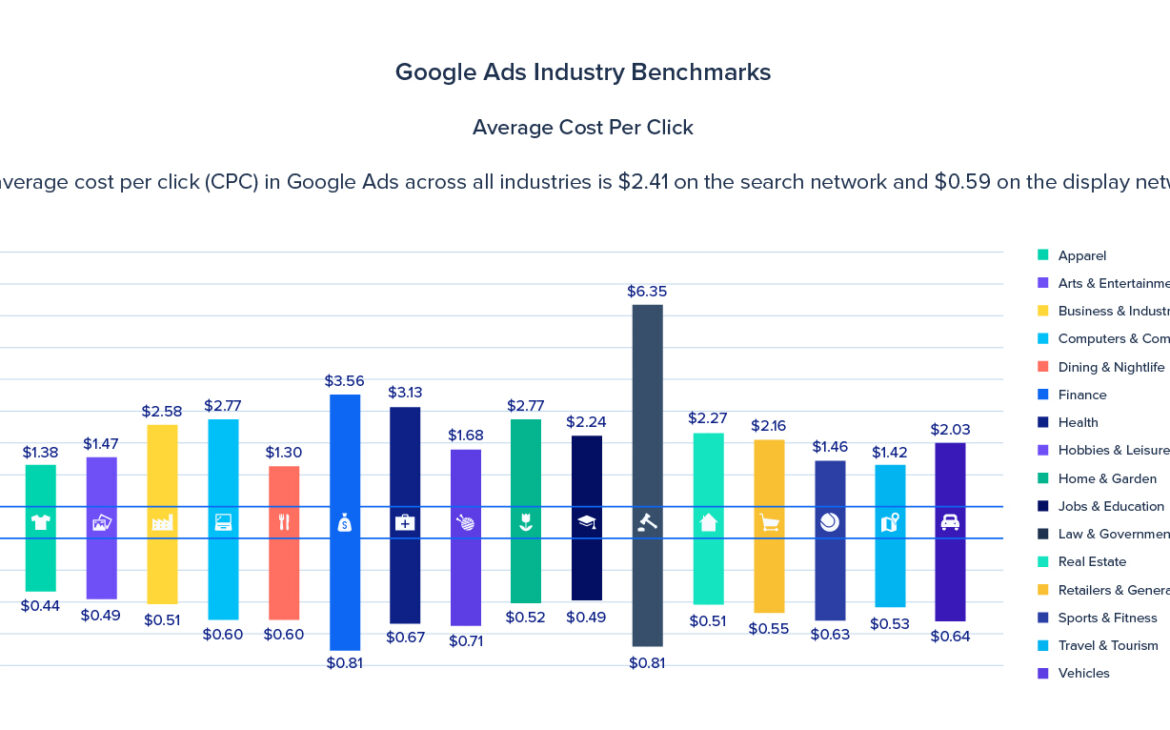

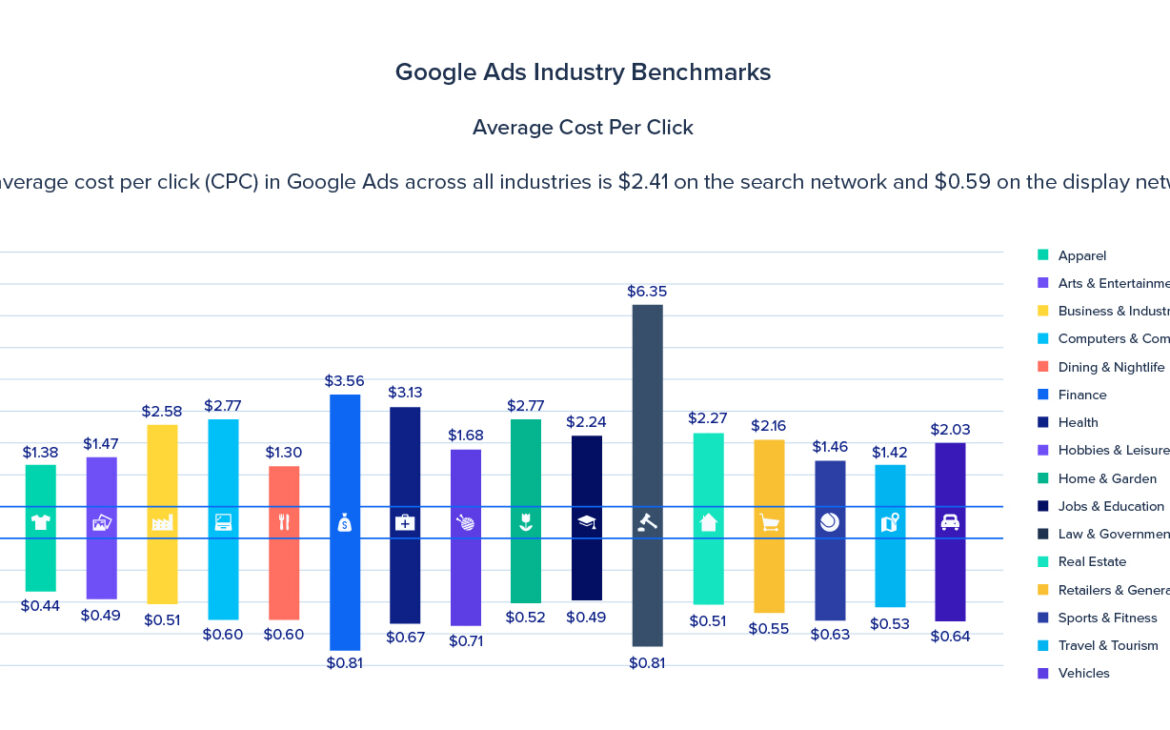

It all starts with CPC (Cost Per Click) which is the money that you pay for each click on your Ad in any of the Paid Marketing networks like Google or Facebook. For a Startup Founder, who was just ignited by an Idea and the passion to take it to heights, all this becomes kind of a drudgery. But, there is no way out of it, so you better spend time on understanding this.

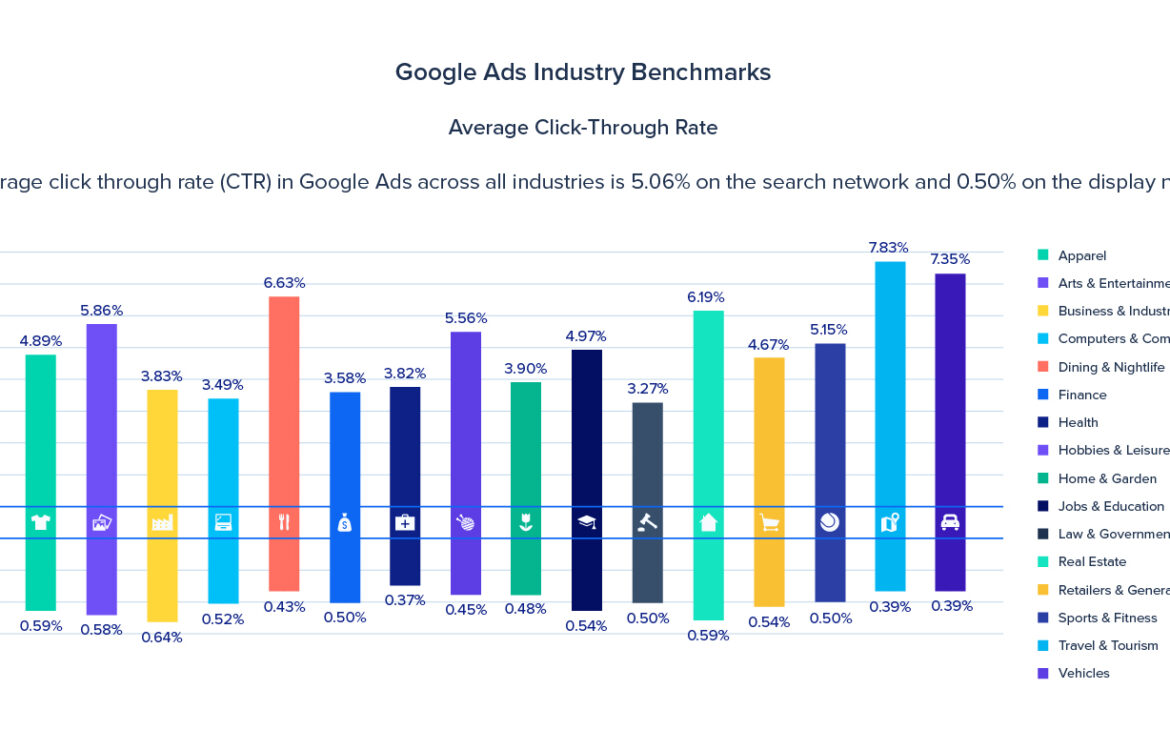

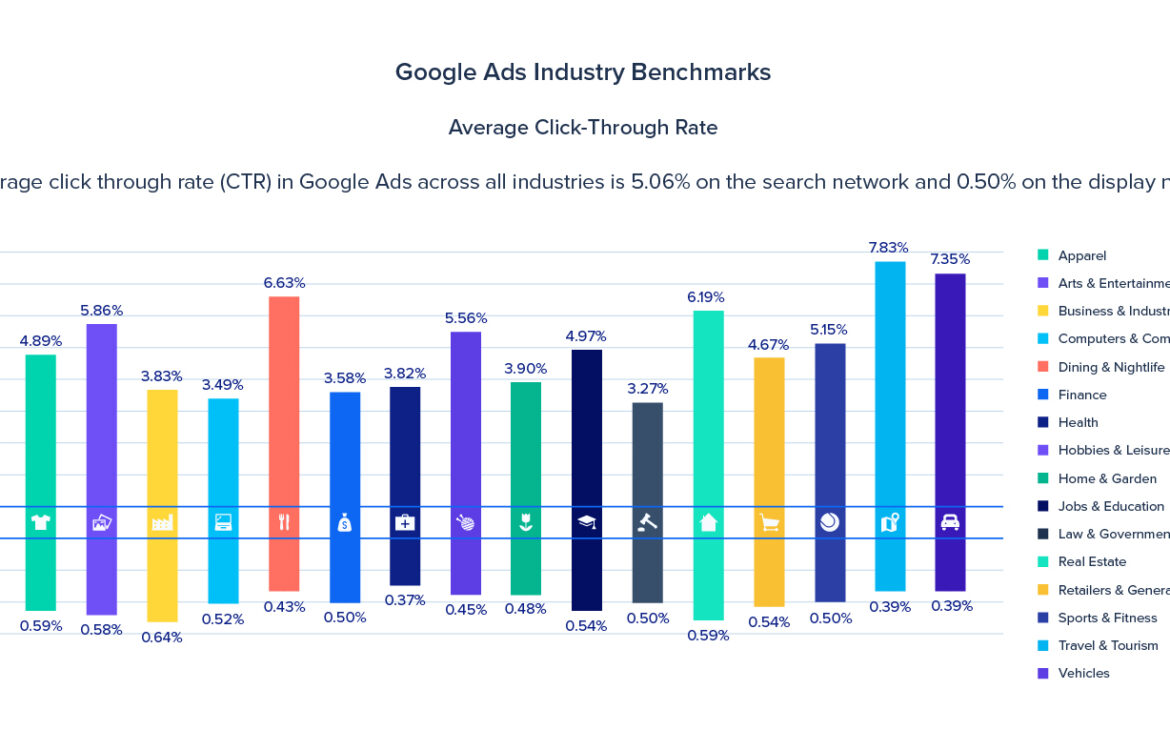

To make it easy for you, here are some statistics which will help you judge the CPC you will incur based on what others in your industry have paid as an average –

So, say you discovered that the average CPC for your product P1 is Rs. 5. Hold these figures in your mind and we will come back to them.

You had discovered in the Revenue Calculations above that you need 500 customers for P1 if you want to achieve Rs. 5000 revenue per year.

Now suppose you decide to execute some Facebook ads to get these 500 paying customers. People will see your ads, this is the Traffic that comes for your ads. If your ad is interesting enough, they will click on your ad. Facebook charges you money for this click. This is CPC (the amount that you pay for each click). Once they click the ad, they will go to your landing page. They find it interesting and they provide their email id and/or phone number on your landing page. Here you got a Lead. Your marketing is over, now sales begin. I would recommend Nurturing Automation to close the sale with a final call in the end. If you are good at it, the Lead becomes a Paying Customer.

Say, from whatever Traffic comes to your ads, 5% click on your ad. This is the Traffic to Click conversion ratio, also popularly called CTR (Click Through Rate).

Now, let’s take some general assumptions that we need to know to do the further calculations. These assumptions may vary depending on industry, quality of ad and many other factors. For example, here is an idea about CTR (click through rate for industry)

Say, 10% get converted to Leads. This is also called Click-To-Lead Conversion Ratio. Also from whatever Leads come through your Landing page, say, 2% get converted to Customers. This is also called Lead-To-Customer Ratio.

We are going to go reverse here now.

For achieving the target of 500 paying customers and considering Lead-To-Customer Ratio of 2% you will need to do the following calculations :

Paying Customers Target = 500

Lead-To-Customer Ratio = 2%

Leads = 500/2% = 25000

For achieving the target of 25000 Leads and considering Click-To-Lead Ratio of 10% you will need to do the following calculations :

Leads = 25000

Click-To-Lead Ratio = 10%

Clicks needed = 25000/10% = 250000

You had arrived at a CPC (Cost Per Click) of Rs. 5 per click above. So, here you have your paid marketing expense calculated as follows :

Clicks needed = 2,50,000

CPC (Cost Per Click) = Rs. 5

Marketing Budget needed = 250000 * 5 = 12,50,000

There will be some miscellaneous marketing costs like Email, SMS costs for organic marketing. There will also be website hosting costs. Like I said earlier, each Startup will have some additional costs over and above the basic costs discussed which they cannot do without.

So, your total Projected Expenses will be as follows :

Project Expenses = Employee Salaries + Tools + Marketing Expenses

WANT TO TALK ABOUT YOUR STARTUP?

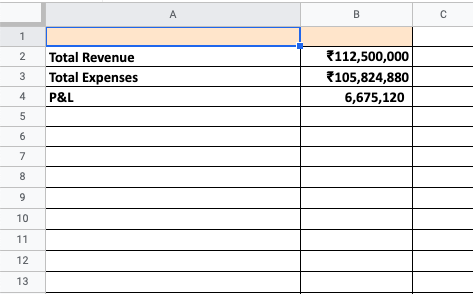

Final Figure – How much Funding do you need

Finally we are at a point where we can arrive at the golden figure – How much Funding do you need?

Well, tap your self funding resources to see how much you can arrange from your kitty. The deficit between that and the Projected Expenses you arrived at above is the figure for the Funding you need.

Hope I could throw some light on arriving at the Funding figure you need. Even if you are self-funded, this will add value to knowing how you can manage your money well to arrive at your targets. This is not a comprehensive calculation with all facts and figures, this is just to give you a high level estimation. If you can add value to this in the comments section, my readers and I would be greatly obliged!

A Fill-In-The-Blanks Template to arrive at the Funding Figure exactly as explained above

Check out the Startup Business Financials Template

An Easy-To-Use Template where you can just Fill in Proejcted Revenues, Expenses etc and have Profit/Loss Projections calculated to give you a simplistic view of where you stand.

This is what you get :

- List down Management and Employee Salaries

- List down Tools and License Expenses

- List Digital Marketing Expenses in a formula based format

- List the Project Revenue based on logical calculations

- Get a simplistic view of Profit/Loss based on Revenue Projections and Consolidated Expenses

- Modify any value anywhere and final values are modified automatically since they are purely formula based